Yearly pay calculator with overtime

Easily convert hourly wage or pay rate to salary. Visit to see yearly monthly weekly and daily pay tables and graphs.

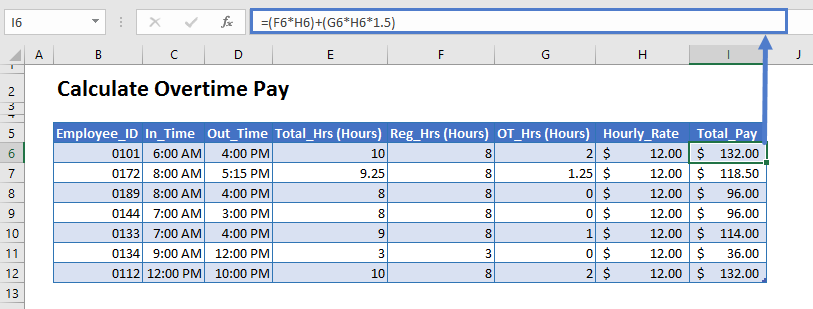

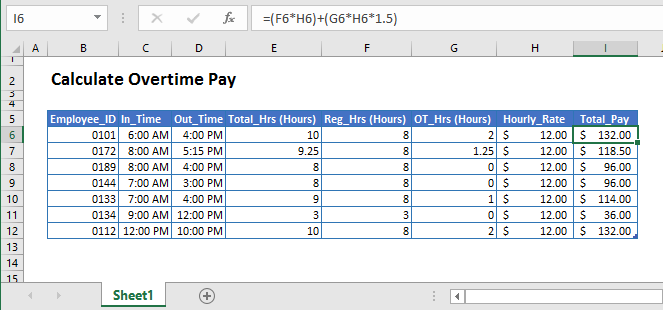

Calculate Overtime In Excel Google Sheets Automate Excel

Pays once per month.

. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if. If you earn 50000 a year then after your taxes and national insurance you will take home 37554 a year or 3130 per month as a net salary. Hourly Pay For Salaried Monthly Salary 160 hours.

Pay 4 times a year. Commonly paid on the 1st and the 15th of each month. Find out what you should earn with a customized salary estimate and negotiate pay with confidence.

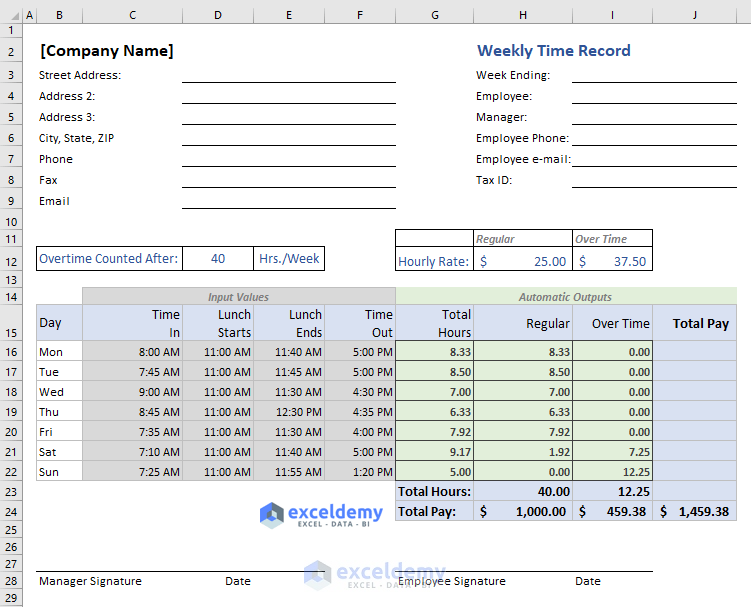

Most hourly employees in New Jersey are entitled to a special overtime pay rate for any hours worked over a total of 40 in a single work week defined as any seven consecutive work days by the Fair Labor Standards Act. Pay every other week generally on the same day each pay period. Employee Overtime Calculator is a ready-to-use template in Excel Google Sheets and OpenOffice Calc that helps you easily calculate overtime.

20000 Salary Take Home Pay. While some states have daily overtime limit which entitles any employee who works for more then a certain number of hours in a single day to be. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Water Intake Calculator new. The government contribution is capped at 154175 per month. Pay each week generally on the same day each pay period.

Car Depreciation Calculator new. Enter your Salary and click Calculate to see how much Tax youll need to Pay. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. Hourly Pay For Salaried Yearly Salary 2080 hours. Based on a 40 hours work-week your hourly rate will be 2405 with your.

Expect 52 pay periods in one year. What is Overtime Pay. The overtime hours are calculated as 15 standard hourly rate but can vary depending on the circumstance eg.

Pay 2 times a year. Expect 12 pay periods in one year. 50000 Salary Take Home Pay.

If the part-time employee ends up working 10 hours a day the individual will be entitled to. Only the hours beyond the full-time working hours are paid at 15 times the hourly basic rate of pay. You can create your own vacation hours calculator for your employees using a spreadsheet software program.

What is Overtime Pay. Pays every two weeks. Pays twice each month.

So if the example worker from above would have an additional 10 overtime hours their salary will be. Inform your career path by finding your customized salary. 50 vacation hours 26 pay periods 192 accrued hours each pay period In conclusion for every pay period an employee reaches it adds 192 hours onto their vacation time.

As long as you work 20 or more of your full-time hours your employer will pay an extra 5 of the remainder of your pay and the government will pay 6167 of the remainder as well. Pay on specified dates twice a month usually on the fifteenth and thirtieth. Pay on a specified day once a month.

For monthly salary this calculator takes the yearly salary and divides it by 12 months. While some states have daily overtime limit which entitles any employee who works for more then a certain number of hours in a. Based on a 40 hours work-week your hourly rate will be 963 with your.

Create a PTO calculator. Income Tax NI Calculator. If you earn 20000 a year then after your taxes and national insurance you will take home 17529 a year or 1461 per month as a net salary.

14hour 120 hours 21hour 10 overtime hours. In our example it gives 14hour 15 21hour. You can factor in paid vacation time and holidays to figure out the total number of working days in a year.

Therefore overtime pay. Hourly rates weekly pay and bonuses are also catered for. Can typically expect 26 pay periods in one year.

Most hourly employees in Ohio are entitled to a special overtime pay rate for any hours worked over a total of 40 in a single work week defined as any seven consecutive work days by the Fair Labor Standards Act. The latest budget information from April 2022 is used to show you exactly what you need to know. 4 hours X hourly basic rate of pay 4 overtime hours X hourly basic rate of pay 2 overtime hours X 15 times hourly basic rate of pay.

If a salaried employee works 2 hours more than his decided limit where his. Yearly Monthly Weekly Hourly. This calculator assumes a work week consists of 40 hours and a work day consists of 8 hours.

Working on Christmas Day. The salary calculator will also give you information on your daily weekly and monthly earnings.

4 Ways To Calculate Annual Salary Wikihow

3 Ways To Calculate Your Hourly Rate Wikihow

Excel Formula Timesheet Overtime Calculation Formula Exceljet

How To Calculate Overtime Pay From For Salary Employees Youtube

Excel Formula Basic Overtime Calculation Formula

Hourly To Salary What Is My Annual Income

Overtime Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculation Formula In Excel Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula To Calculate Hours Worked Overtime With Template

Overtime Calculator To Calculate Time And A Half Rate And More

How To Calculate Wages 14 Steps With Pictures Wikihow

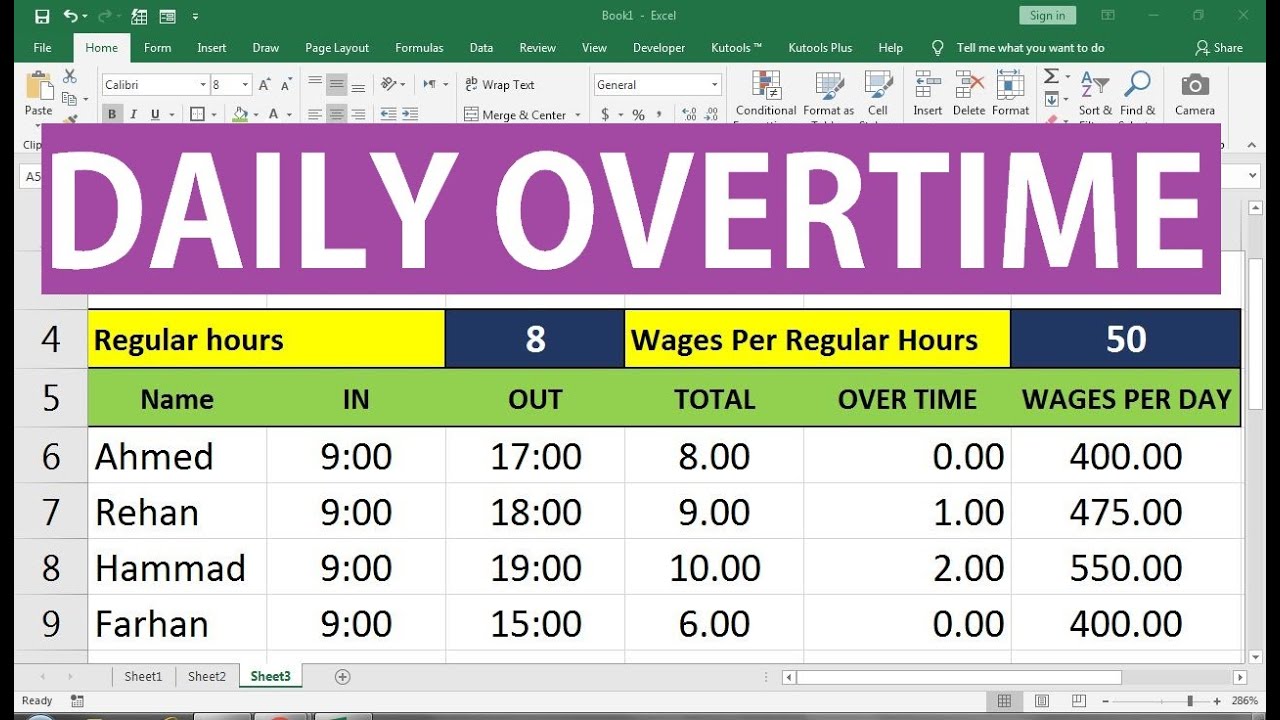

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Excel

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Hourly Paycheck Calculator Step By Step With Examples

Calculate Overtime In Excel Google Sheets Automate Excel